Payment transactions at a glance

We are below providing you with the most important details for payment transactions. This will give you an overview of current developments, new security functions and practical advice for your day-to-day transfers.

The new EU Instant Payment Regulation, which comes into force in October 2025, will involve important changes in payment transactions such as an extension of real-time transfers and new security functions: verification of the payee and a new daily limit for online banking.

What will change as from the beginning of October?

1. Verification of payee:

Every transfer will involve an automatic verification of the payee: the name of the payee indicated is compared with the name of the account holder of the specified IBAN. The result of this comparison is displayed before the payment is released – this procedure will reduce the number of erroneous transfers.

Results of payee verification

The payee verification procedure can have four possible outcomes:

The payee's name is identical

The name of the payee entered by you is identical with the owner of the payee account.

The name of the payee is almost identical

The name of the payee entered by you is almost identical with the owner of the payee account and is correctly displayed in the result of the verification procedure.

Example:

Payee’s name that was entered: A. N. Othre

Verification result: A. N. Other

In such case we recommend that you again reconcile the details with the payee.

The payee's name is not identical

The name of the payee entered by you is NOT identical with the owner of the payee account.

In such case we recommend that you again reconcile the details with the payee.

Payee verification not possible

It was not possible to verify the payee (e.g. if the account has been closed or in the event of a technical problem, etc.).

We recommend that you again reconcile the details with the payee or try again later.

Please note

We would ask you to check your templates in 24You online banking and in the MobileBanking app now, and to adjust the payee names accordingly. Make sure that you use the full name – e.g. Mary Other instead of “Grandma”, or Insurance Plc instead of “vehicle insurance”.

2. New daily online banking limit

For your own protection, a new daily limit will be introduced for online transfers:

- The system recommends a daily online banking limit of 3,000 euros (with the exception of internal transfers between the user’s Bank Austria accounts, and securities transactions). This can be either confirmed upon login or adjusted on an individual basis.

- Applies to 24You online banking and the MobileBanking app.

- You can change the limit whenever you wish, with the change taking effect after a security period of two hours.

- You can, if you wish, set your own limit for real-time transfers, which will apply to all customer channels.

You can execute real-time transfers:

- In the MobileBanking app

- In 24You online banking

- At the Konto-Manager (Account Manager) machine

- At the counter in your Bank Austria branch

Links & Downloads

Payments With Payment Slip at the Account Manager.Step-by-Step (PDF)

Plaćanje putem uplatnice u Konto menadžeru. Korak po korak (PDF)

Hesap Yöneticisi ile Ödeme Fişiyle Kolay Havale. Adım Adım Açıklama (PDF)

Activation of the MobileBanking app: Step-by-Step

Register for Online banking

Bank Austria MobileBanking app: Overview of key features (PDF)

Bank Austria MobileBanking Aplikacija: Pregled važnih funkcija (PDF)

Bank Austria Mobil Bankacilik Uygulamasi: Tüm bankacılık işlemleriniz bir arada (PDF)

Questions & answers

-

What is the difference between a SEPA standard transfer and a real-time transfer?

With a SEPA standard transfer the payee usually receives the funds within 1 to 2 business days. With a real-time transfer the funds reach the payee within a few seconds – day and night including weekends and holidays.

-

Are there any additional costs for a real-time transfer?

No. Real-time transfers do not give rise to additional costs compared to a SEPA standard transfer.

-

Do I first have to authorise the real-time transfer?

No. As from 5 October 2025 the real-time transfer network will automatically be available in all channels: in the MobileBanking app, in 24You online banking, at the Konto-Manager (Account Manager) machine and at the counter in your Bank Austria branch.

-

Which accounts will be eligible for real-time transfers?

All payment accounts. Other accounts such as savings accounts or loan accounts do not support real-time transfers.

-

Will the payee verification procedure also apply to SEPA standard transfers?

Yes. As from 5 October 2025 payee verification will be performed for every SEPA transfer order – i.e. also standard transfers – before the order is authorised.

-

Will payee verification function for transfers to all banks?

Yes, within the SEPA region – depending on the payee’s participating bank.

-

What happens if payee verification for my transfer yields a negative result?

You can authorise the transfer all the same. In such case we however recommend that you reconcile the data with the payee before carrying out the payment.

-

Will the new daily online banking limit also apply to SEPA standard transfers?

Yes. The limit applies both to SEPA standard transfers and real-time transfers.

-

How can I protect myself from fraud when making real-time transfers?

New security functions such as payee verification and the daily online transfer limit offer enhanced protection against erroneous transfers and fraud.

- The recommended daily online banking limit is 3,000 euros (with the exception of internal transfers between the user’s Bank Austria accounts, and securities transactions).

- It applies to 24You online banking and to the MobileBanking app, and the amount can be either confirmed upon login or adjusted on an individual basis.

- You can change the limit whenever you wish, with the change taking effect after a security period of two hours.

You can also set your own limit for real-time transfers, which will cover all customer channels.

This gives you full control of your payments while protecting you against large or unintentional transactions.

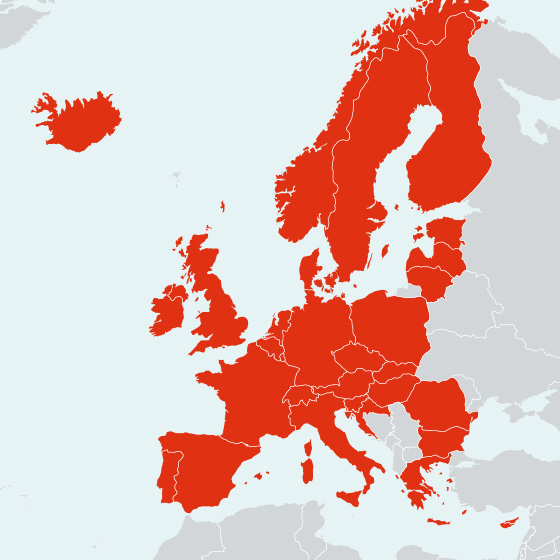

SEPA comprises the countries of the eurozone: Belgium, Germany, Estonia, Finland, France, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Austria, Portugal, Slovakia, Slovenia, Spain and Cyprus.

The following countries of the EU are included for euro payments: Bulgaria, Denmark, Croatia, Poland, Romania, Sweden, Czech Republic and Hungary.

The following countries of the European Economic Area (EEA) are included: Great Britain, Iceland, Liechtenstein and Norway. In addition, Switzerland, Monaco and San Marino St. Pierre and Miquelon, Guernsey, Jersey and Isle of Man.

Questions & answers

-

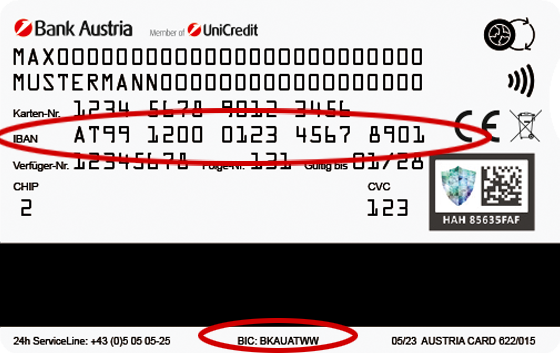

What do BIC and IBAN mean?

The BIC is the internationally used identification code of a bank, often referred to as the SWIFT code. The IBAN is a globally standardized, unique identifier for a bank account. It consists of a country code, a bank code, an account number, and a check digit. You can find both numbers on the back of your new debit card.

SEPA standard transfer

The SEPA standard transfer is the customary payment transfer method. The payee usually receives the relevant amount within one to two business days. It can be carried out in the bank’s branches and self-service zones or simply online via the MobileBanking app or 24You online banking.

It is very straightforward:

In the MobileBanking app under › Aufträge › Neuer Auftrag › Zahlungsanweisung

In 24You online banking under > Überweisung > Neue Überweisung

Photo transfers

With the MobileBanking app you can also quickly and safely issue instructions for a standard or real-time transfer via a photo transfer. A photo of the invoice or payment slip is sufficient to automatically capture all the data. After a brief check payment is made by fingerprint, facial recognition or ATC. It’s easy – no typing!

It is very straightforward:

In the MobileBanking app under › Aufträge › Fotoüberweisung

Standing order

A standing order is suited for recurring payments such as rent or electricity.

This involves a cashless transfer of a fixed amount to a specific payee account, which is regularly made at a predetermined time (e.g. on every fifth day of a month).

It is very straightforward:

In the MobileBanking app under › Aufträge › Neuer Dauerauftrag / Dauerauftragsübersicht › Neuer Dauerauftrag

In 24You online banking under › Überweisung › SEPA Daueraufträge › Dauerauftrag hinzufügen

SEPA direct debit

With a SEPA direct debit mandate (pre-authorised payment order) you permit the payee of a payment to debit your payment account with an amount. The amount can always vary, e.g. as with a telephone bill.

You normally receive the form for a pre-authorised payment order (SEPA direct debit mandate) from the payee. This is often filled in and signed by you when concluding a contract. The form is frequently also available later via the website or in the branch of the payee. After the contract has been signed, the payee attends to the remaining payment details with the bank.

Apart from the credit and debit of standard payments, and the crediting or payment of and with foreign cheques, at Bank Austria there are more options to make payments. Bank Austria is at your side as a competent partner, with an extensive network of the UniCredit Group in Austria, Germany, Italy and Central and Eastern Europe. For the standard prices for outgoing payments, please see the latest price list in Bank Austria branches.

Information on exchange rate pricing (foreign exchange dealing) by UniCredit Bank Austria AG

UniCredit Bank Austria AG executes payment orders for which a foreign currency needs to be converted into euros or from euros into a different foreign currency at the earliest possible exchange rate, depending on availability of the foreign currencies listed on the exchange rate list. This exchange rate is determined in line with market practice in international foreign exchange markets, no later than around noon on the business day following the date on which the order has been issued, and is published in display of exchange rates at Bank Austria. This means that the exchange rate which will be applied to the payment cannot be indicated at the time when the order is issued.

For currencies which are not listed in the display of exchange rates by Bank Austria, the fixing of exchange rate will depend on the foreign correspondence bank whose services are used and this process cannot be influenced by UniCredit Bank Austria AG.

Important information: The regulations of the Payment Services Act (ZaDiG) at the time of receipt and implementation deadline do not relate to the exchange rate pricing, rather to the implementation of a payment order after completion of the formation of exchange rate.