UniCredit Bank Austria Purchasing Manager Index in November

Tailwind for Austrian industry at the end of the year

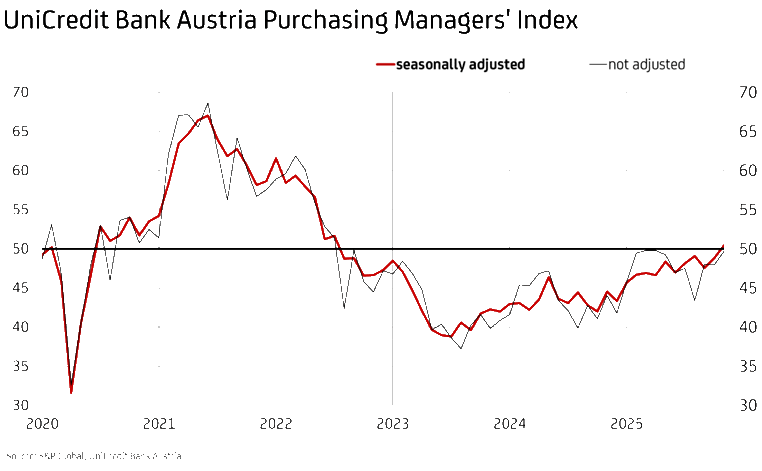

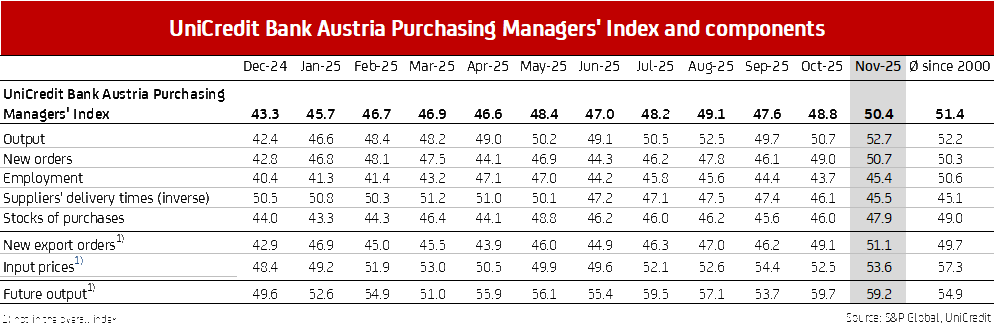

- The UniCredit Bank Austria Purchasing Managers' Index rose to 50.4 points in November, exceeding the neutral threshold for the first time since July 2022

- Following the first increase in new business in 43 months, production expanded slightly again

- The decline in employment slowed somewhat in November

- The pace of destocking of raw materials and input materials declined

- With output prices remaining relatively constant, the further rise in input prices caused a deterioration in the earnings situation for domestic companies

- Optimism continued: The index for production expectations for the year as a whole reached 59.2 points, only slightly less than in the previous month

The cautious improvement trend in Austrian industry stabilised in the final quarter. “The UniCredit Bank Austria Purchasing Managers' Index rose to 50.4 points in November, signalling growth for the first time since summer 2022 by exceeding the neutrality line of 50 points,” says UniCredit Bank Austria Chief Economist Stefan Bruckbauer, adding: “However, the economic situation in industry remains tense. A stable, sustainable growth phase is still not in sight at the turn of the year 2025/26. International indicators, among other things, speak against this. The purchasing managers' indices for the manufacturing industry in the US and the eurozone deteriorated in November. In Europe, the indicator even fell below the neutrality threshold again at 49.7 points, weighed down by declines in the main markets of France and Germany.”

The improvement in the UniCredit Bank Austria Purchasing Managers' Index in November, which bucked this negative trend by as much as 1.6 points compared to the previous month, was probably in part a delayed reaction to the more favourable European values of the previous months and could therefore prove to be short-lived. “The rise in the UniCredit Bank Austria Purchasing Managers' Index in November was due to an improvement in all components. Particularly pleasing was the first increase in new business in 3.5 years, which led to a slight rise in production and slowed the decline in employment somewhat. Due to uncertainty about the sustainability of the current positive development, the cautious purchasing policy was continued and stocks of primary materials were reduced, especially as costs rose even more sharply than in previous months,” says Bruckbauer, summarising the most important results of the monthly survey.

First increase in new business in 3.5 years

For the fifth time in the past seven months, domestic industry increased its production output in November compared to the previous month, and the pace has increased significantly. At 52.7 points, the production index reached its highest level for over three years. The main driver for the increase in production was the improvement in demand.

“In November, more new orders were recorded than in the previous month for the first time since May 2022. Although new orders rose only slightly, this marked the end of the longest phase of declining orders since the survey began 27 years ago. The turnaround in export demand also played a major role in this. At 51.1 points, the new export order index even slightly exceeded the index for total new orders of 50.7 points,” says UniCredit Bank Austria economist Walter Pudschedl.

Domestic companies attributed the improved order situation to targeted domestic sales initiatives on the one hand and increased demand from neighbouring European countries, particularly Germany, on the other. The capital goods industry benefited from the conclusion of contracts for some major projects and led the turnaround in order development.

Job cuts slowed down

In view of the long period of weak orders, the current improvement in the industrial economy has not been enough to reverse the negative trend on the labour market. At 45.4 points, the employment index at November continued to indicate a significant decline in staffing levels in the sector, although at least at a slightly slower pace than in the previous month. For around two and a half years, staffing capacities in the domestic industry have been adjusted to the lower production requirements. Since then, the number of employees in manufacturing has fallen by around 27,000 to just under 620,000. Most jobs were lost in the manufacturing of metal metal products, motor vehicle manufacturing and glass production. In line with the strong focus on industry, Upper Austria accounted for over 30 per cent of job losses in Austrian industry and Styria for just under 20 per cent. The employment situation remained most stable in Viennese industry. With a share of 8.5 per cent of Austrian industrial employment, it only accounted for 2 per cent of Austria-wide job losses.

“Despite the reduction in employment, the number of jobseekers in industry has now stabilised, supported by demographic factors. The seasonally adjusted unemployment rate in manufacturing has levelled off at 4.3 per cent. We also expect an average unemployment rate of 4.3 per cent in 2025 compared to just 3.8 per cent in 2024,” says Pudschedl, adding: “Despite the major challenges, the reduction in employment in Austrian industry should slowly come to an end over the course of the coming year. We expect the unemployment rate to stabilise at 4.3 per cent in 2026. This means that the unemployment rate will continue to be significantly lower than in the economy as a whole. However, the gap will narrow slightly in view of the expected decline in the overall economic unemployment rate from 7.5 per cent in 2025 to 7.4 per cent in 2026.”

Restraint in purchasing and warehousing is easing somewhat

Improved demand and higher production requirements have already prompted some companies to increase purchasing volumes. On average, however, efforts to streamline inventories and increase liquidity prevailed, leading to an overall slowdown in the decline in purchasing volumes. Although demand for operating resources was still relatively restrained overall, suppliers' delivery times lengthened. Reduced capacities at suppliers and raw material bottlenecks on the market were cited by the companies surveyed as reasons for the most recent delays.

“As a result of the slowdown in purchasing activities, inventories of primary materials and raw materials fell in November at the lowest rate in the past six months. While many companies specifically reduced their inventories for cost reasons, the proportion of companies that increased their stocks of operating materials in order to fulfil increased production requirements or to adapt their supply to changing demand increased,” says Pudschedl. While inventories of raw materials fell more slowly, stocks of finished goods remained largely unchanged. A moderate increase in stocks of finished goods in the intermediate goods segment contrasted with slight decreases in the capital goods and consumer goods industries.

Stronger rise in costs, almost stable output prices

Austrian companies had to contend with sharply rising costs in November - as a result of higher energy prices, higher prices for fruit, computer chips and copper. The index for purchase prices rose to 53.6 points. Selling prices, on the other hand, fell for the seventh month in a row, as suppliers' pricing power remained limited due to fierce competition and restrained demand. However, the rise in the corresponding index to 49.7 points signalled an extremely small price decline.

“The current price trends with sharply rising purchase prices and almost stable sales prices once again led to a deterioration in the profit margins of domestic industrial companies in November. This unfavourable earnings trend has been observed in ten out of eleven months of the current year,” says Pudschedl.

Optimism continues, but industrial improvement is on shaky ground

The renewed rise in the UniCredit Bank Austria Purchasing Managers' Index shows that the consolidation of the industrial economy is continuing. It is also positive that the index ratio "new orders to inventories" has risen above 1 for the first time this year, signalling that demand will lead to production increases compared to the previous month, at least in the short term, taking into account existing inventory capacities. In addition, the business expectations of domestic companies remain optimistic. Although production expectations for the next twelve months fell slightly in November compared to the previous month, they are still well above average.

“The moderate upward trend in the industrial economy stabilised towards the end of 2025. The UniCredit Bank Austria Purchasing Managers' Index even exceeded the neutrality threshold for the first time in three and a half years. However, this is unlikely to be the starting signal for a sustainable, dynamic recovery in domestic industry,” says Bruckbauer, adding: “In view of the geopolitical risks and home-made competition problems caused by high cost increases, the industrial economy in Austria will remain subdued in the coming months, burdened above all by the challenges in exports due to a subdued global economy and the protectionist trade policy of the USA. Following the 2.5 per cent increase in industrial production on average in 2025, which is primarily due to a low prior-year base, we expect real production growth of around 1.5 per cent in the coming year.”

Enquiries:

UniCredit Bank Austria Economics & Market Analysis Austria

Walter Pudschedl, Phone: +43 (0) 5 05 05-41957;

E-mail: walter.pudschedl@unicreditgroup.at